Unfortunately, QuickBooks doesn't allow you to send over an invoice or journal entry if you have more than one foreign (non-home) currency in the transaction. This means that if Amazon converts your payment to a currency that is not your home currency, you will have to take additional steps by using a clearing account.

In the below example, our base currency in QuickBooks is AUD. Amazon converts the Amazon.ca (CAD) payment to a USD Bank account.

Head over to your chart of accounts and select New to create a new account.

The currency of the clearing account should match the currency of the marketplace (e.g., USD for Amazon.com, GBP for Amazon.co.uk, etc.)

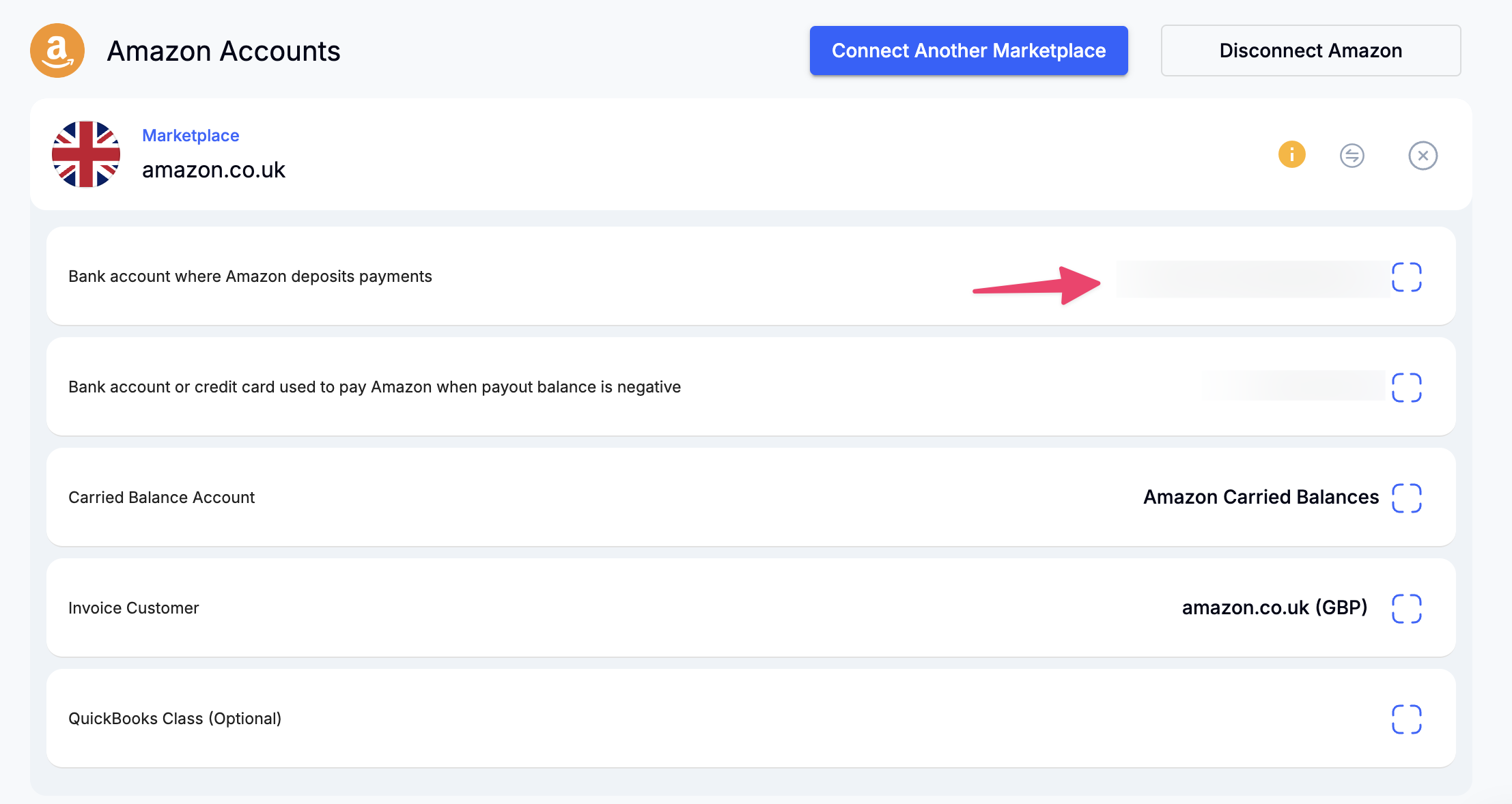

Go back to taxomate and then Settings > Connections and then attach the new clearing account to the proper marketplace.

Go back to your Settlements and send one to QuickBooks. You should see it appear in your clearing account in QuickBooks.

When you receive the payment from Amazon, and it shows up in QuickBooks under your bank account, you can now transfer the funds from the new clearing account to your bank account. You will then be able to match in your bank account.