Taxomate allows you to set up accounting mapping to properly send your settlements or payouts to QuickBooks, Xero, or Wave.

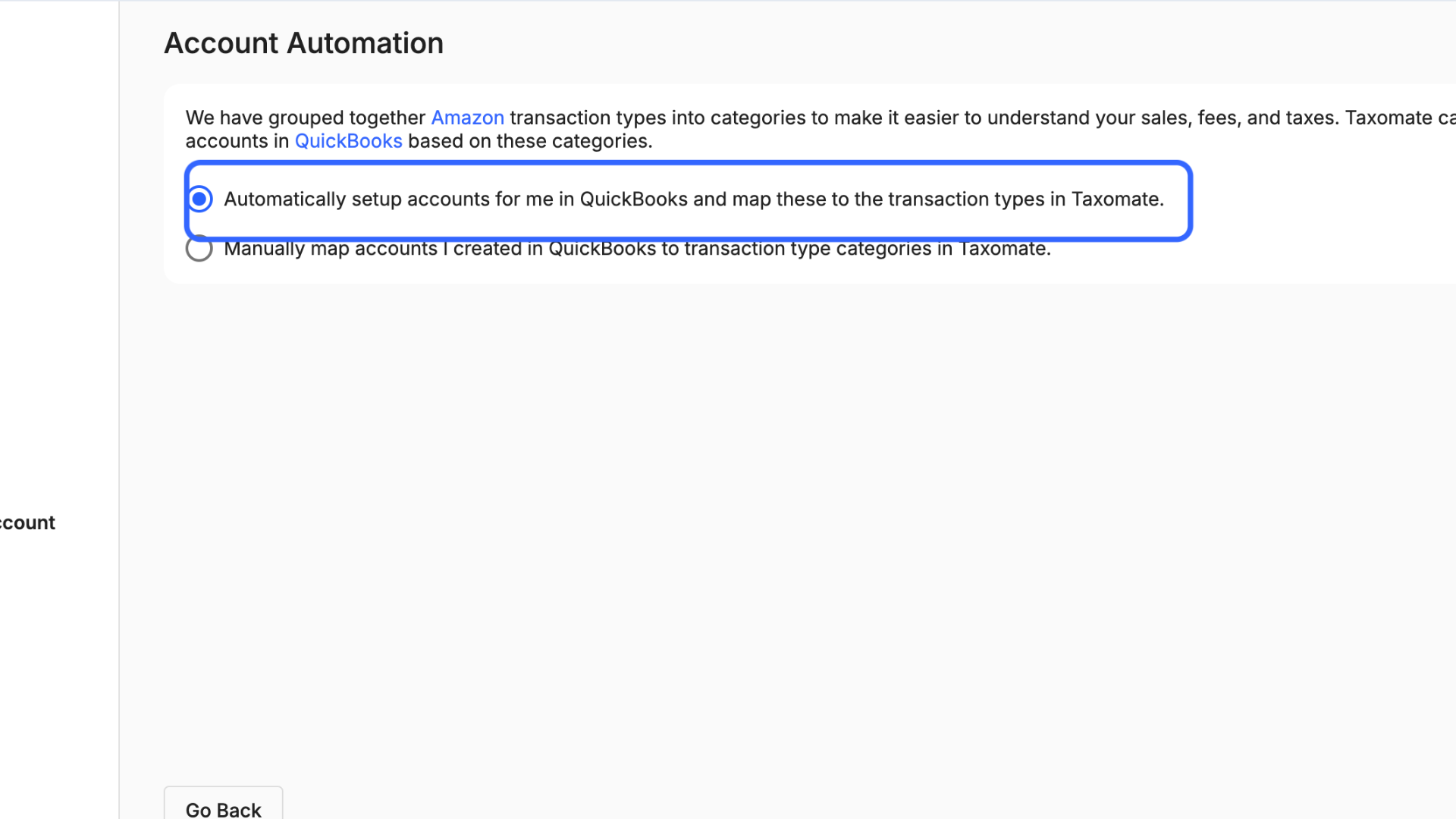

The easiest way to get started is to have Taxomate automatically generate sales, fees, etc., accounts for you.

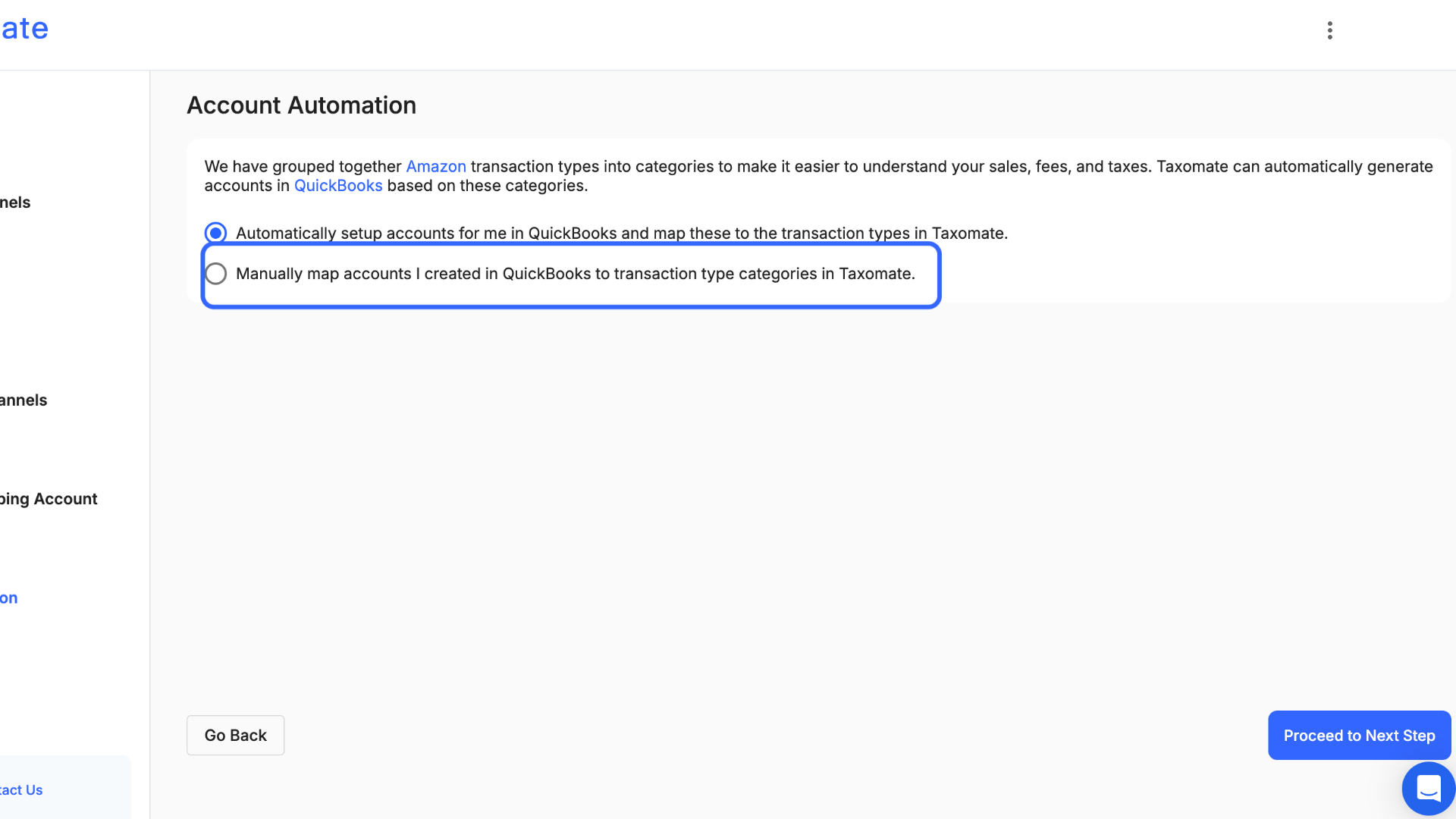

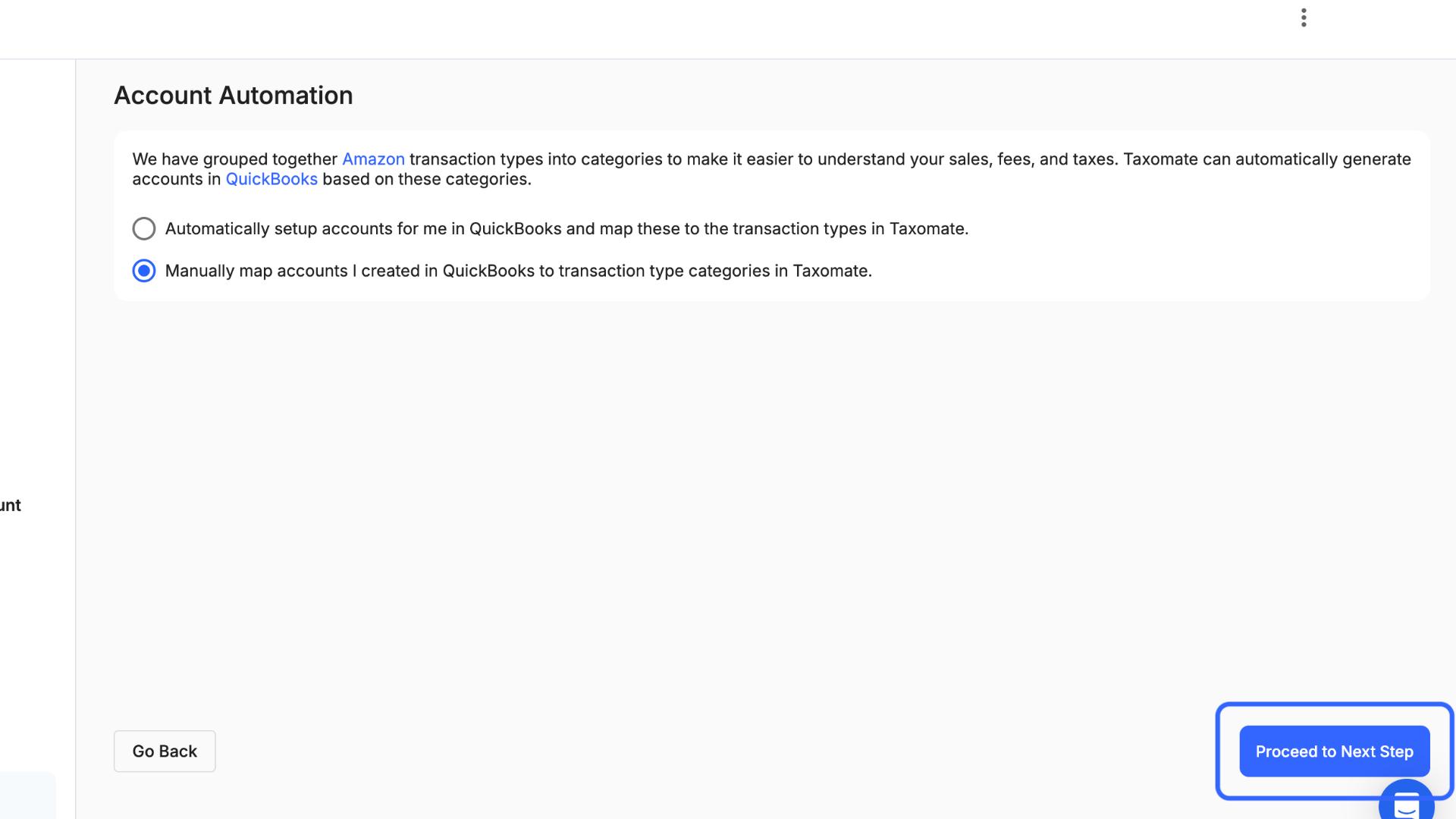

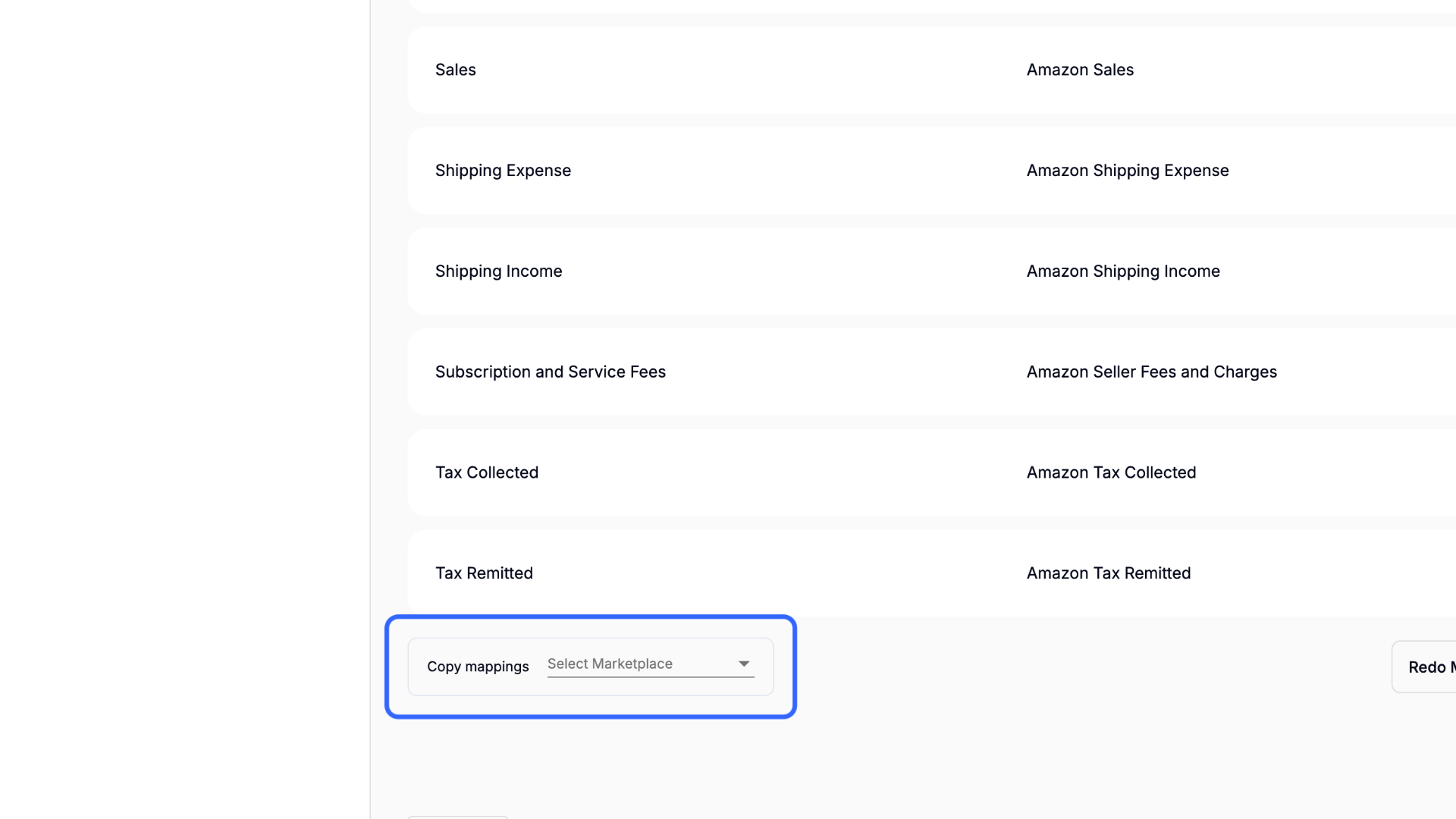

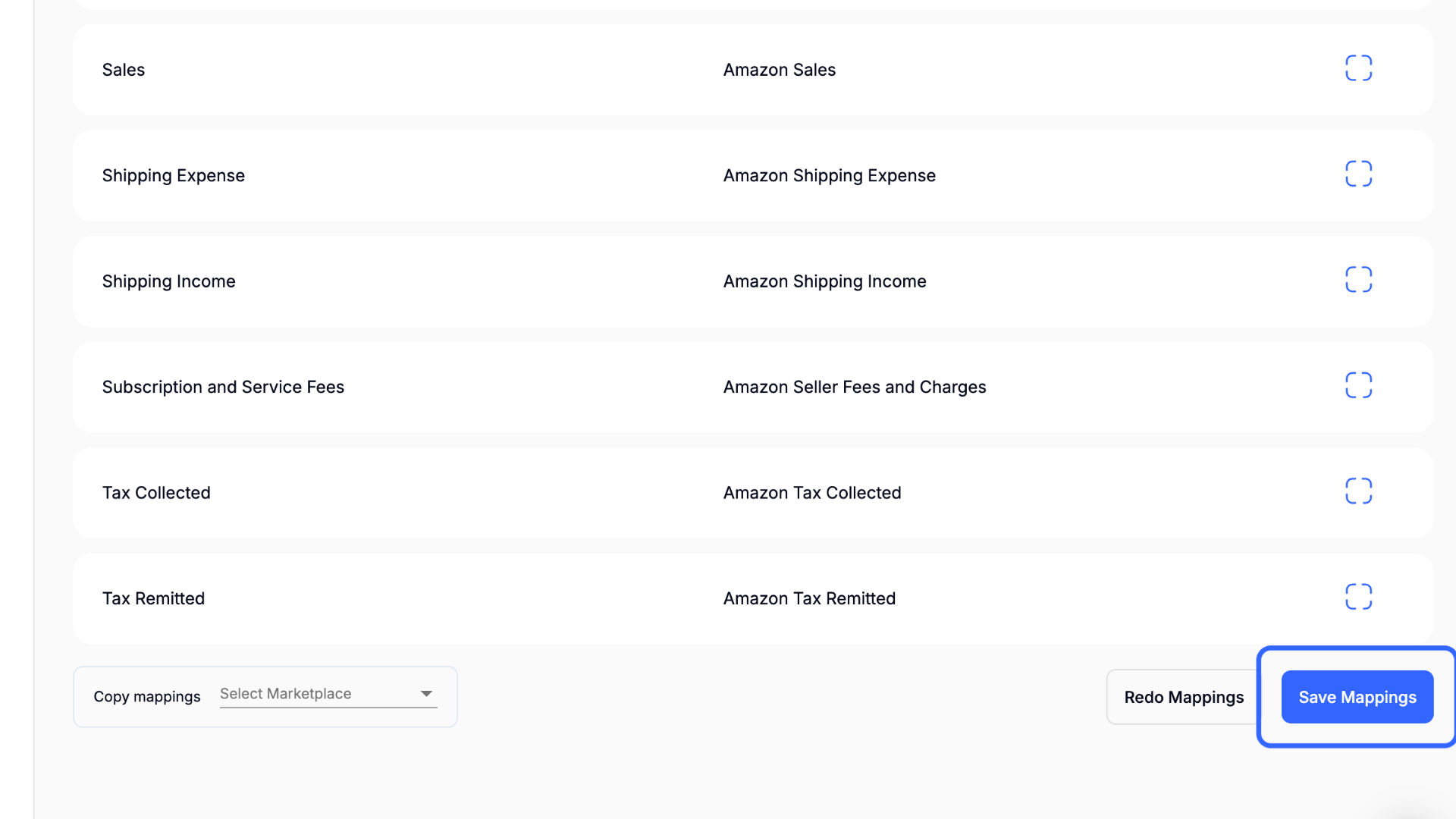

You can also manually map accounts you created in your accounting software to transaction type categories in Taxomate.

Click on the Proceed to Next Step button.

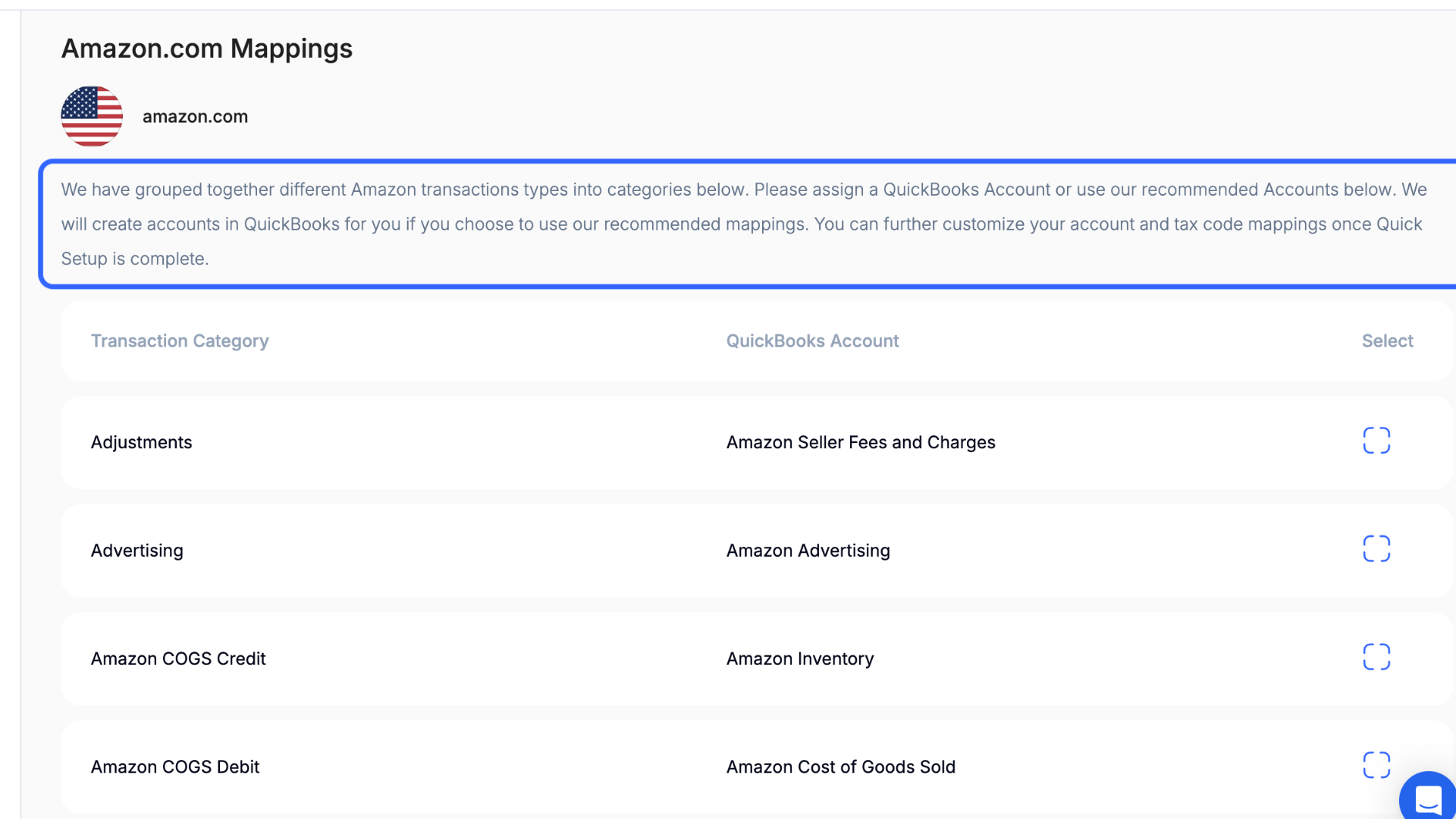

Assign an account from your accounting software to one of the transaction type categories. You can further customize your account and tax code mappings once Quick Setup is complete.

If you are connecting multiple Amazon or eBay marketplaces, you can copy mappings from one country marketplace to another.

Once you finished mapping your accounts, select the Save Mappings button.

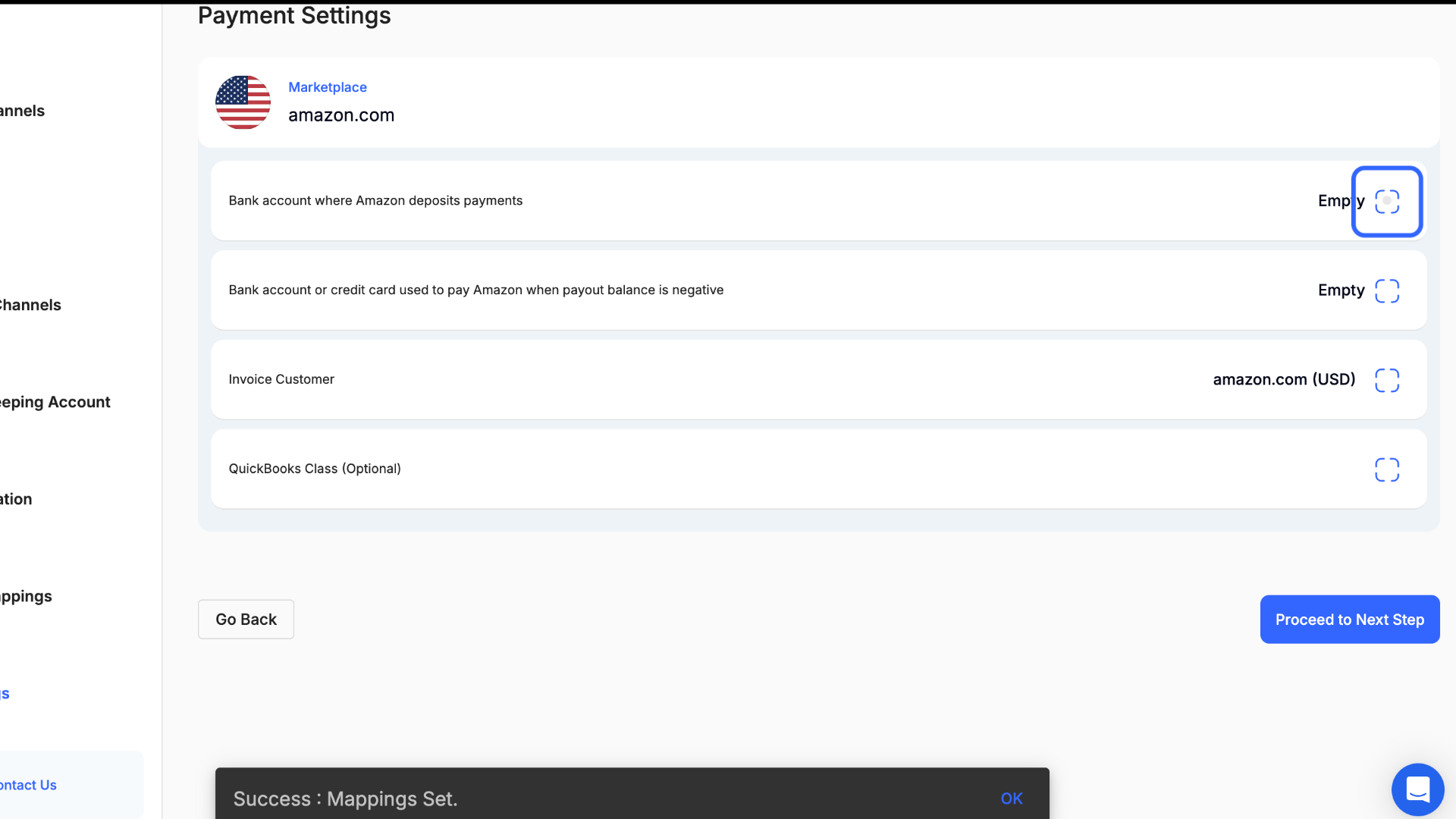

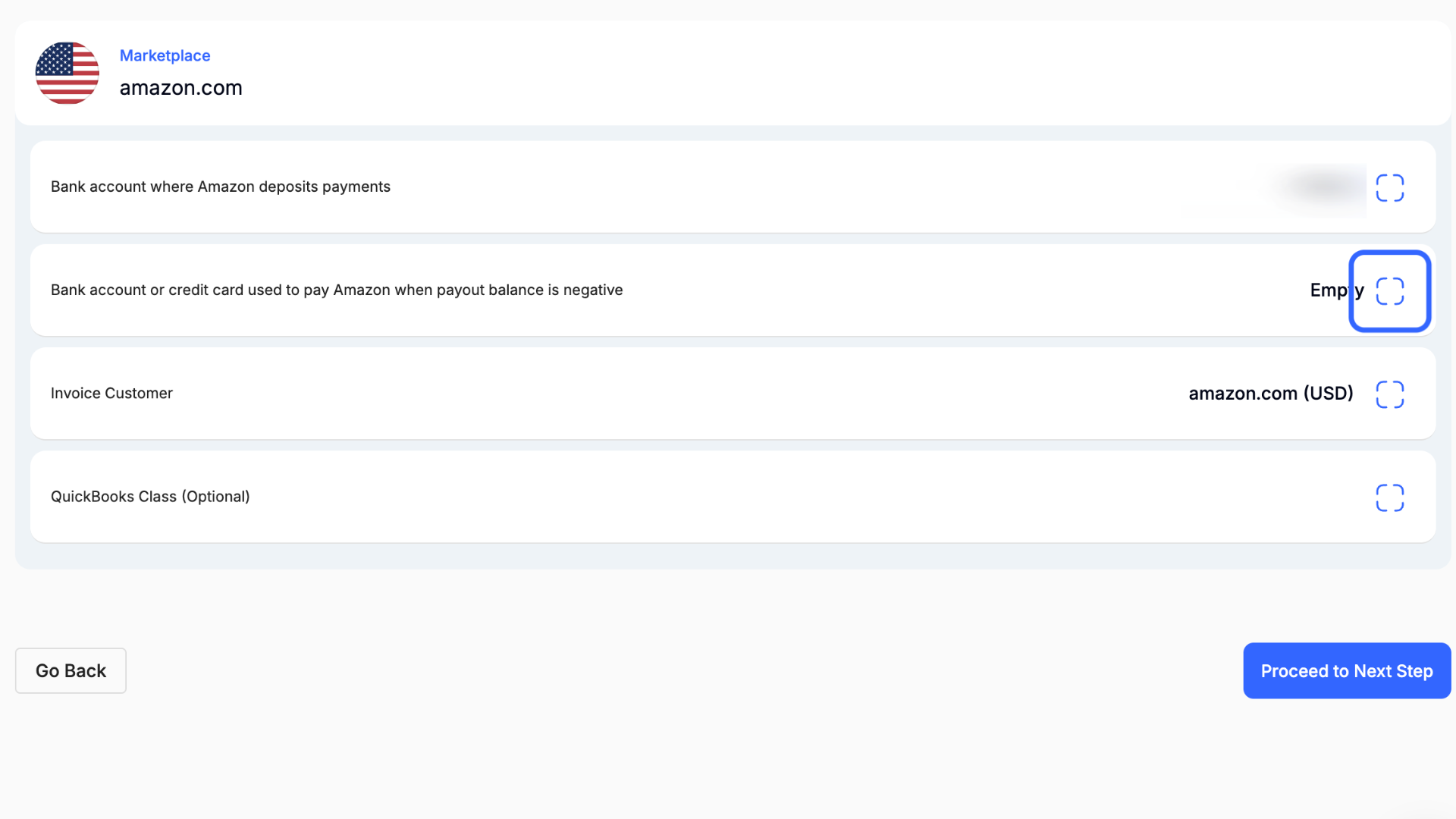

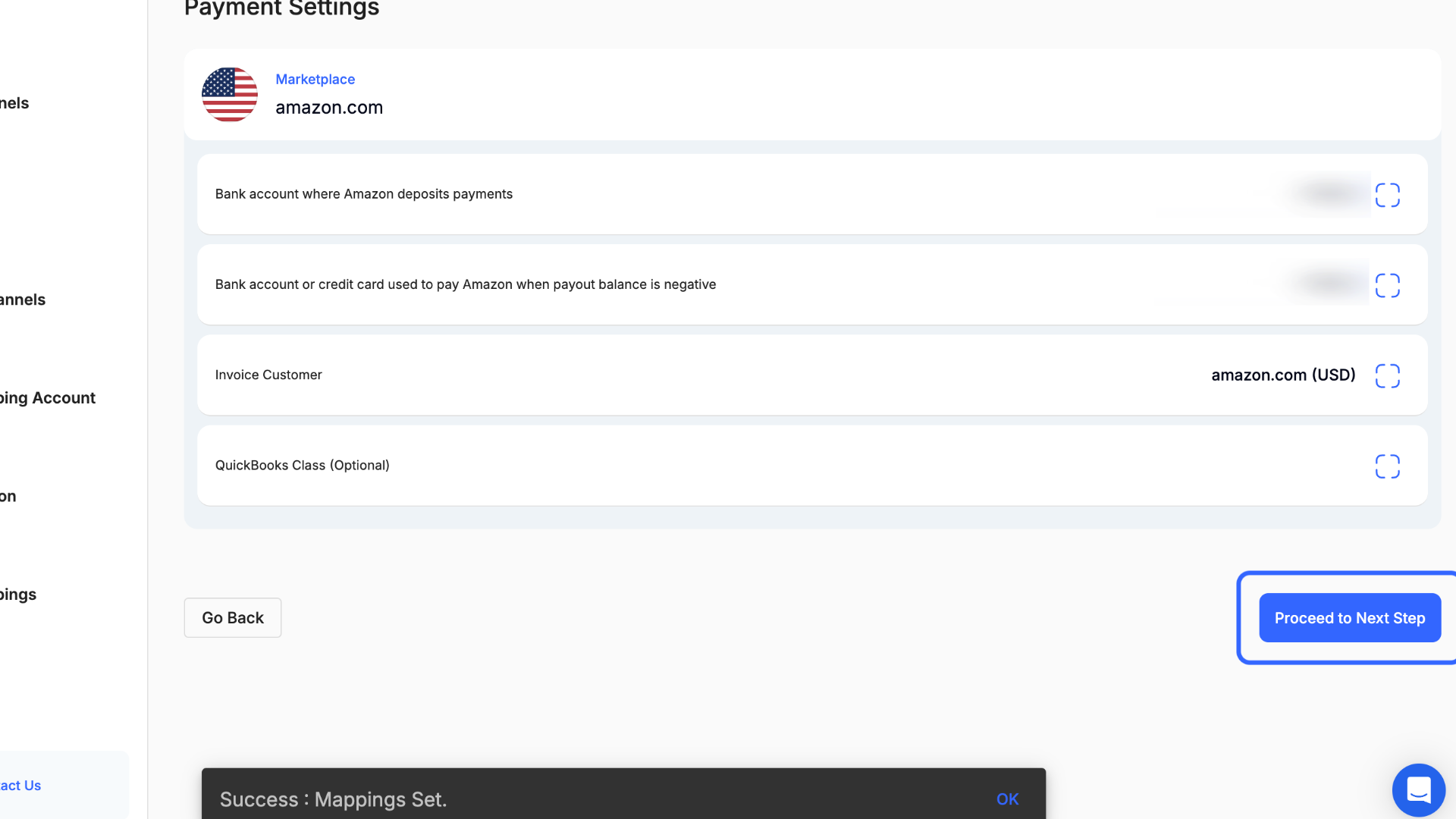

In the final step of Quick Setup, and if you are using QuickBooks, select the bank account where you receive your sales channel payments. For Amazon or eBay, you will need to make a selection for each Amazon country marketplace you add.

👉 You will not see this option if you are using Xero or Wave.

Next, select the bank account or credit card used to pay Amazon when you owe Amazon money.

You will also see selections for Invoice Customer and QuickBooks Classes. We recommend leaving the invoice customer as-is.

For QuickBooks Classes, you can use this to track transactions in QuickBooks reports for each marketplace. Xero allows you to do this with tracking categories.

Click on the Proceed to Next Step button to finish Quick Setup and be taken to your settlements or payouts.

If you need to change these accounts after completing Quick Setup, go to the Accounts & Taxes page and select Update Mappings at the bottom.