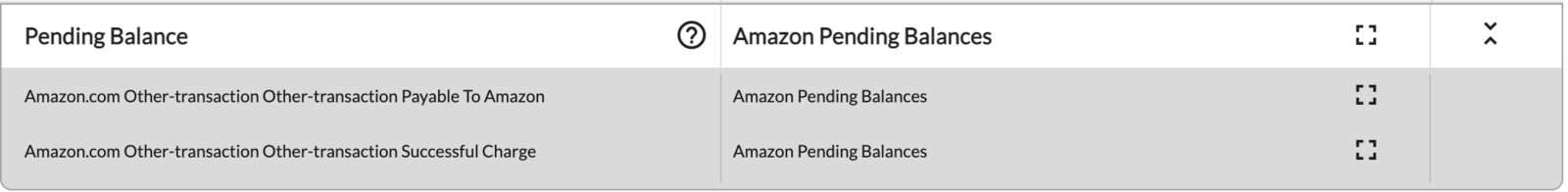

Sometimes you may see Payable to Amazon and Successful Charge in your settlement or in Accounts & Taxes under Pending Balance:

Payable to Amazon is the amount you owe Amazon, which is usually carried over from the last settlement.

Successful Charge is usually any money you’ve paid Amazon through your credit card. So if you have 0 sales and a -39.99 subscription fee on your settlement, you’ll see a 39.99 Successful charge entry on your next settlement.

There are two different scenarios you may see within your settlements:

When you are a new seller Amazon may charge your credit card directly for Amazon seller subscription fees or where the total fees are greater than any revenue. In this case, Amazon will charge your credit card directly (usually because you are a new seller).

In this "negative" settlement you will see a "Subscription Fee" transaction type and if you are using the default accounts, it will be mapped to Amazon Seller Fees and Charges.

After sending this settlement to your accounting software, you can match it directly with the credit card charge from Amazon.

In the next settlement period, you will see both Payable to Amazon and Successful Charge line items that are equal. Since these line items balance each other, nothing else is required.

Sellers who have been on the Amazon platform may have any settlement period where money owed is deducted in the following settlement (instead of charged to your card directly).

In this case, instead of both "Payable to Amazon" and "Successful Charge" line items appearing in the next settlement, only a "Payable to Amazon" line item will appear in the next settlement.

In your accounting software, you will want to create a bank clearing account to allocate both the original settlement and the Payable to Amazon line item on the next settlement.

STEP 1. In QuickBooks find the applicable journal entry or invoice where the fees are greater than revenue (negative settlement).

STEP 2. Change the bank account in the journal entry or invoice to the bank clearing account you created.

STEP 3. Open the journal entry or invoice for the next settlement and find the line item "Payable to Amazon". Change the account for this line item to the same bank clearing account you created above.

STEP 1. In Xero find the applicable bill where the fees are greater than revenue (negative settlement). Go to Business > Bills to pay and select the Awaiting Payment tab.

STEP 2. Open the bill, scroll down and select Make a payment. Enter the amount of the bill and select the bank clearing account you created above.

STEP 3. Open the invoice for the next settlement and find the line item "Payable to Amazon". Change the account for this line item to the same bank clearing account you created above.

STEP 1. In Wave find the applicable journal entry or invoice where the fees are greater than revenue (negative settlement).

STEP 2. Manually record a payment for the invoice and assign it to the bank clearing account you created above.

STEP 3. Go to Transactions and filter by the bank clearing account you created. Find the applicable transaction and change the account from the bank clearing account to match the account "Payable to Amazon" is mapped to in the next settlement.