Sometimes settlements/payouts are sent to QuickBooks with fees and costs being higher than the revenue (negative settlements). This usually occurs if you are a new seller when you tend to owe Amazon, eBay, Shopify, Walmart, or Etsy money.

When this occurs, and you are using invoices, we send over a credit memo for any negative portion of the settlement.

If you are using our receive payment option (highly recommended), we also send over an expense and a payment to make it easier to reconcile with any credit card or bank charges you have from your sales channel.

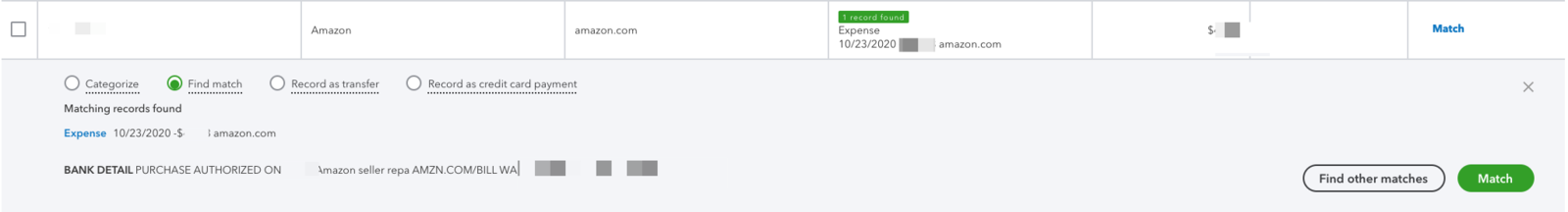

All you need to do is match the expense we sent from taxomate to the credit card or bank charge you received from your sales channel.

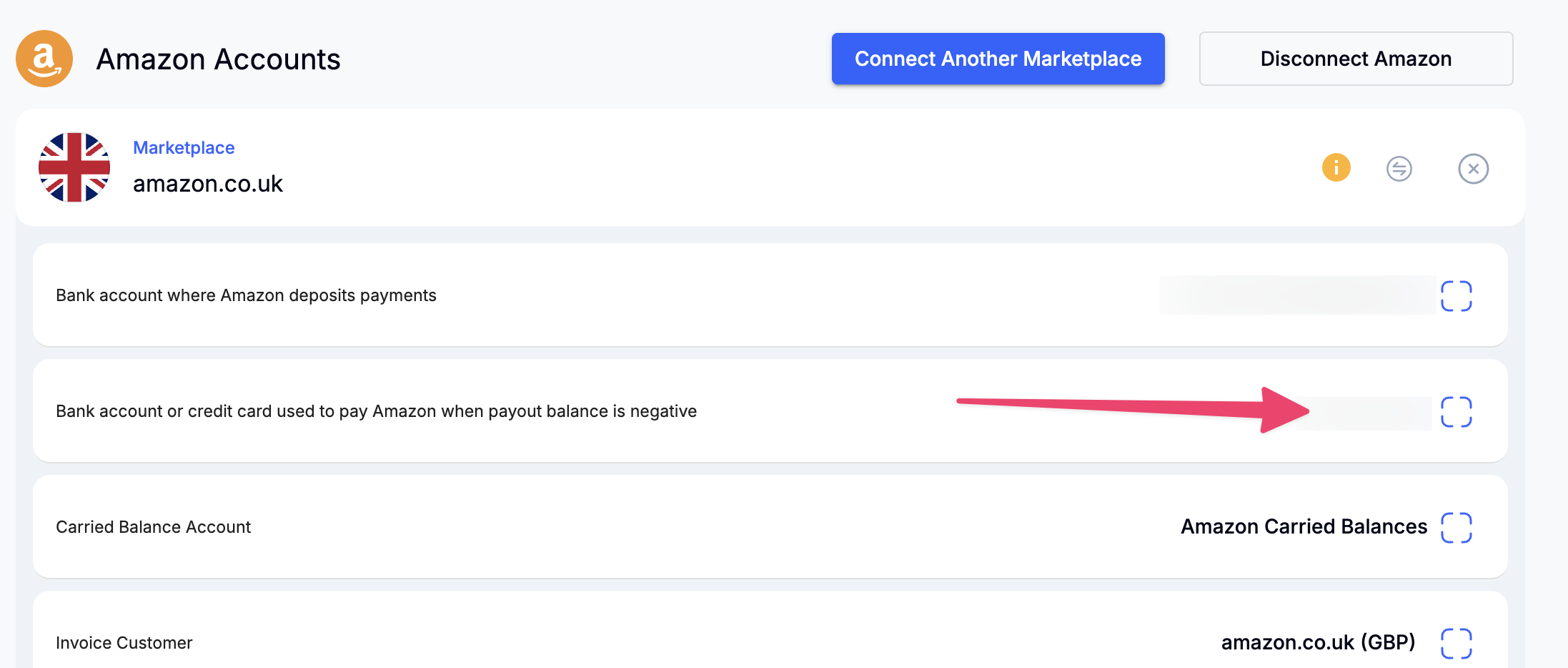

IMPORTANT: Ensure you have the proper credit card or bank account set for when your payout balance is negative and your sales channel charges you.

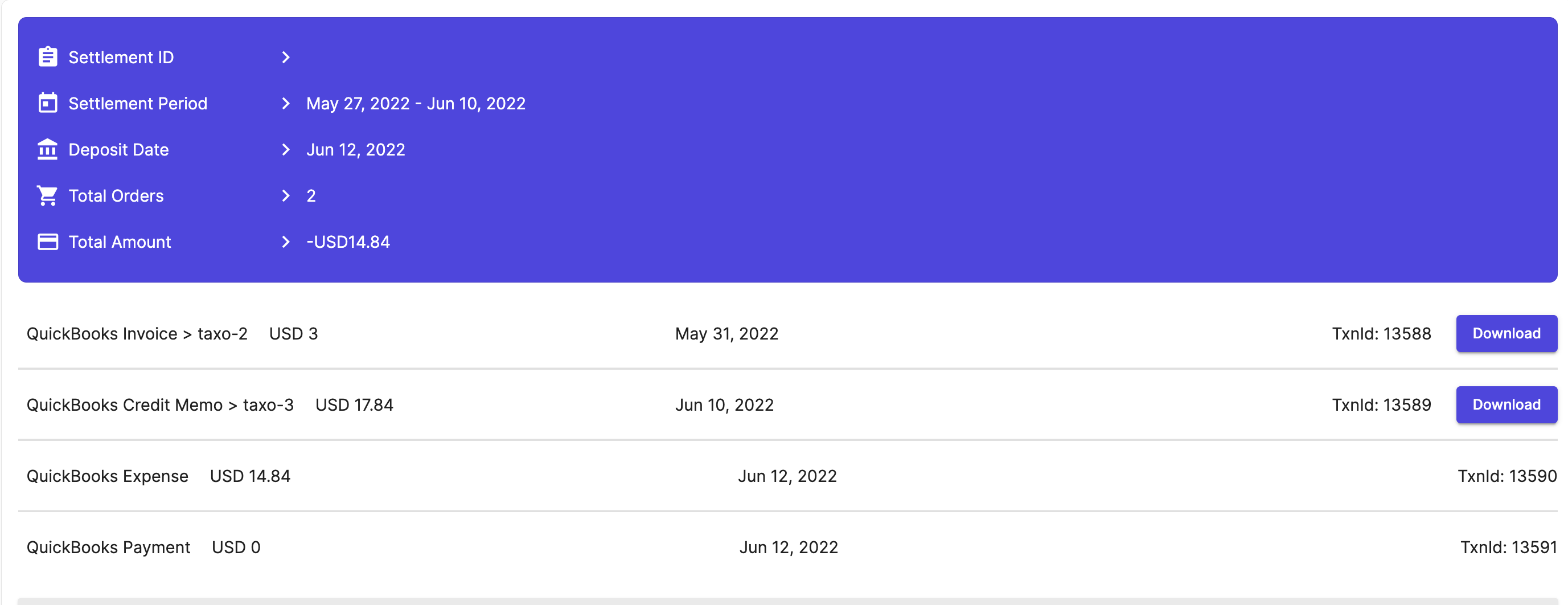

If you have a split settlement (spans multiple months), you may see an invoice, credit memo, expense, and payment, which are all linked and ready to be reconciled (shown below). As above, all you would need to do is match the expense to the credit card or bank charge from Amazon.

Please note: The following process is no longer required since an expense is now automatically sent along with a credit memo and payment. If you are not using our receive payment option, you may want to use these instructions.

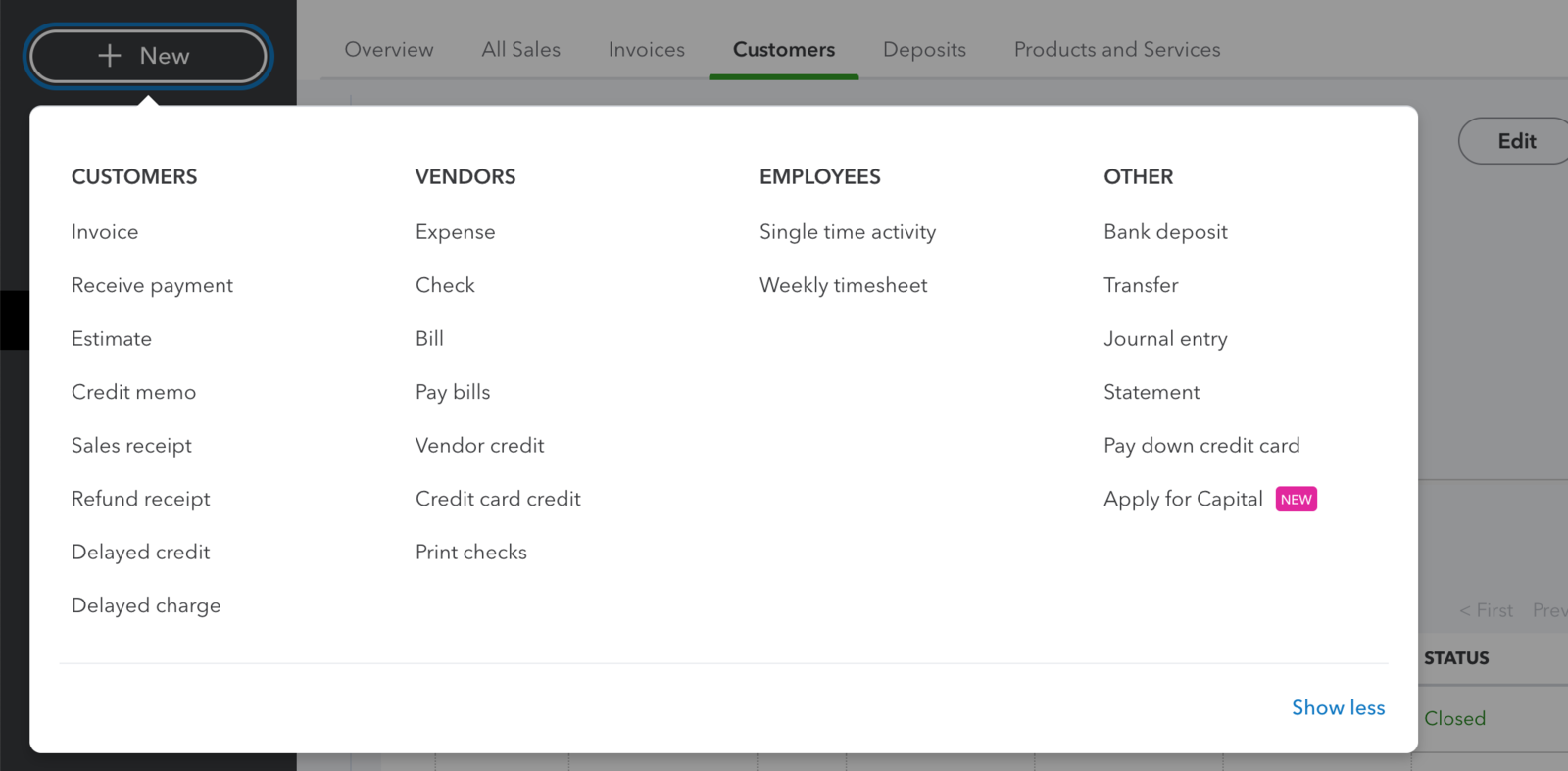

STEP 1. Create an expense by going to New and under Vendors and selecting Expense.

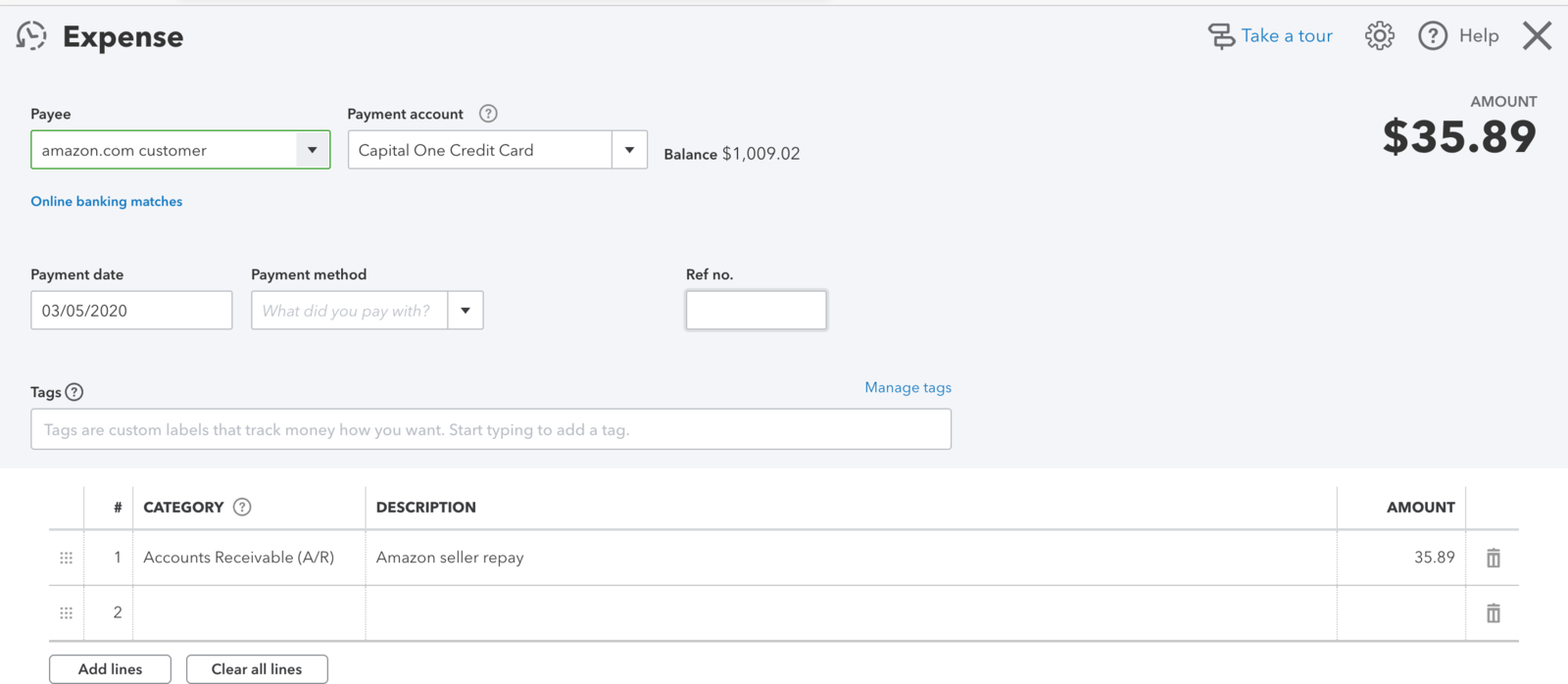

STEP 2. Select amazon.com customer (or applicable marketplace) as the Payee and your credit card account as the Payment Account (or account you make the payment from).

For the payment date, select the date of the charge.

For the category, select Accounts Receivable and then enter the amount charged to your credit card under Amount.

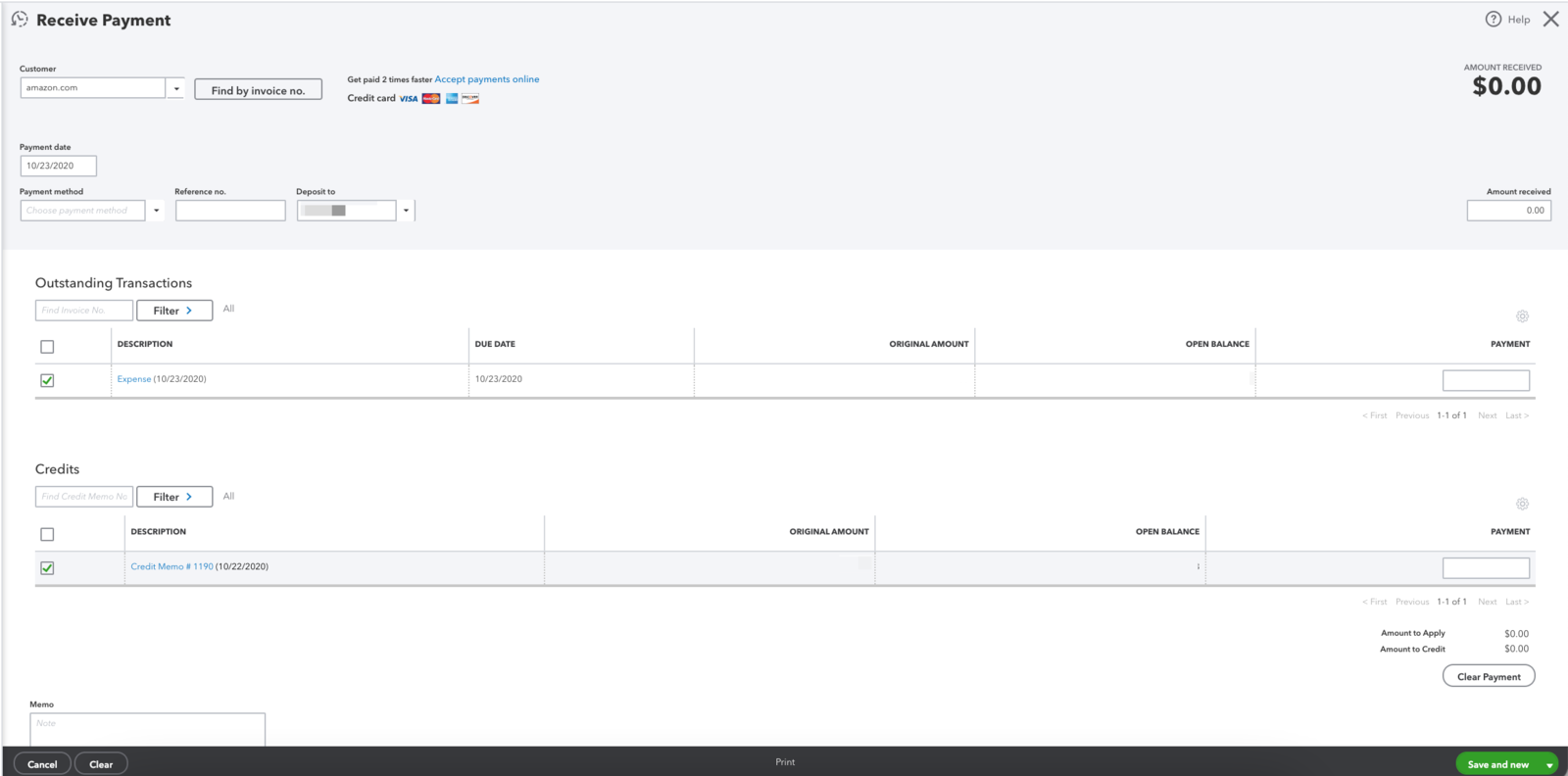

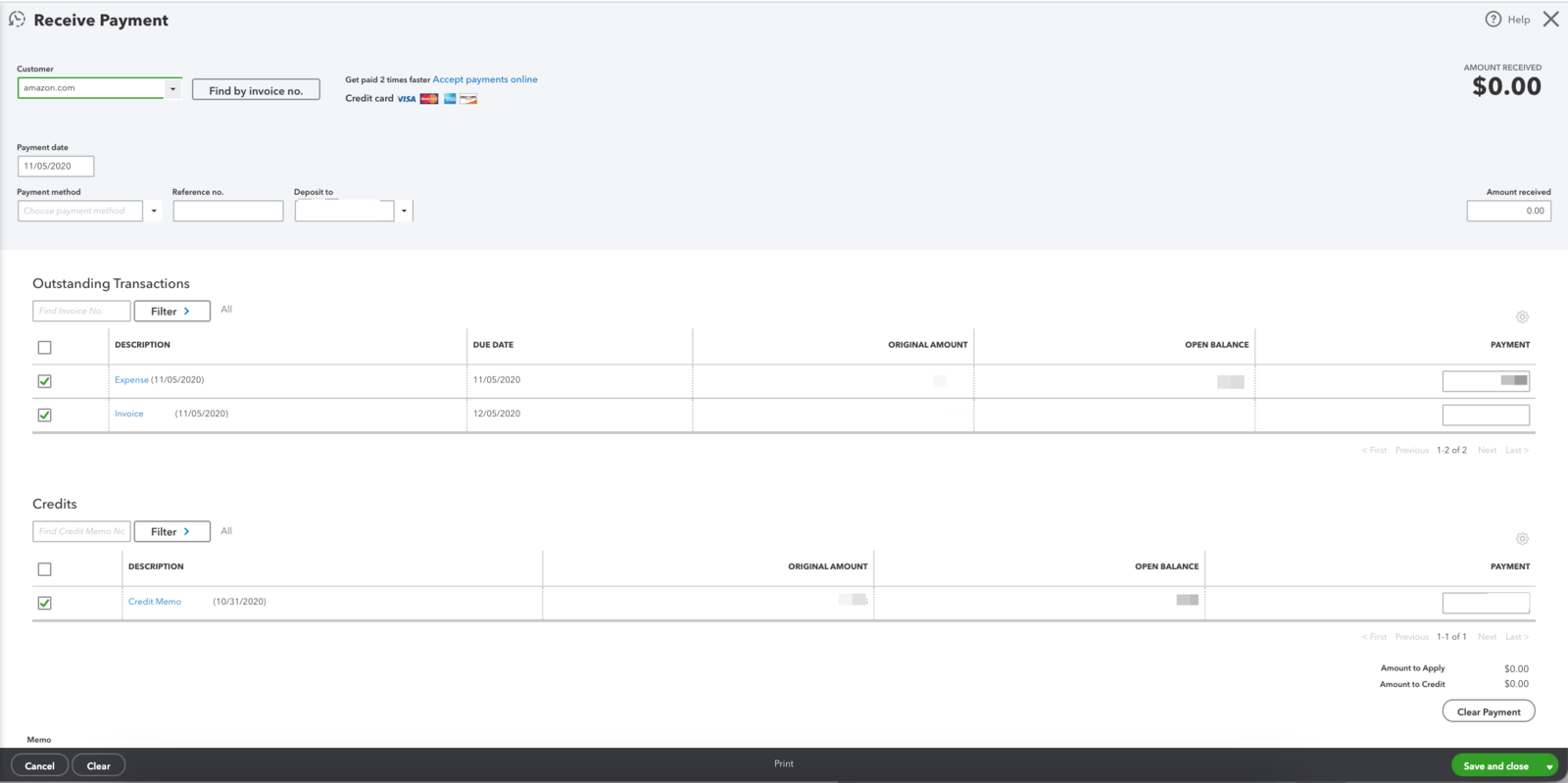

STEP 3. Go to Receive Payment and select the Expense you created and Credit Memo so they balance each other out to 0. For credit card accounts you deposit to Undeposited Funds. Select Save and close.

This is how your screen will look if there is just a credit memo:

If you have both a credit memo and invoice, your screen will look like this:

STEP 4. Head back over to your bank/credit card account and find the transaction where you paid Amazon.

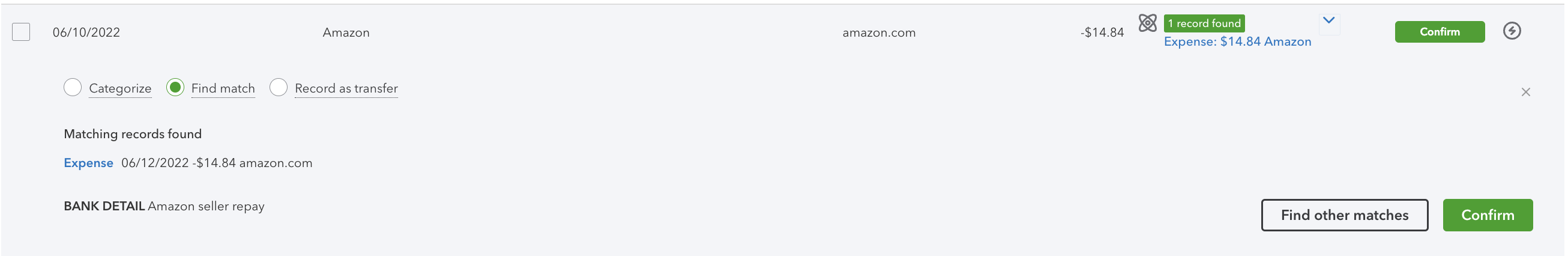

If you paid with your bank account, select Match.

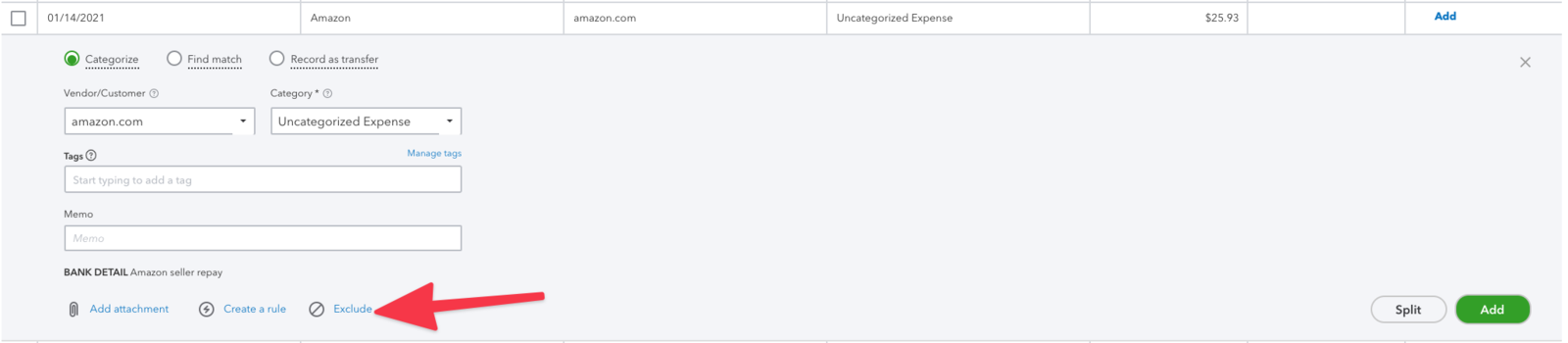

If you paid with your credit card, you can Exclude the transaction.