Sometimes Amazon withholds your payment. This is common if you are a new Amazon seller. If this occurs, your settlements may be $0. There are two instances where this occurs:

Example A: You have a $0 Amazon settlement in a single month.

Example B: You have a $0 Amazon settlement spanning two different months.

Example C: Settlement has a balance greater or less than $0.

Where the $0 settlement is not split, all transactions will be sent to QuickBooks, Xero, or Wave in one invoice or journal entry.

Within the invoice, you will Current Reserve Amount, which is the amount withheld by Amazon. When the reserve amount is released by Amazon you will see Previous Reserve Amount Balance show up in a future invoice.

Both Current Reserve Amount and Previous Reserve Amount Balance will be sent to the Amazon Reserved Balances account.

The $0 invoice does not need to be matched and nothing else is required on your end.

When the $0 settlement spans two months, taxomate will send two journal entries, two invoices, or one invoice and one credit memo to QuickBooks.

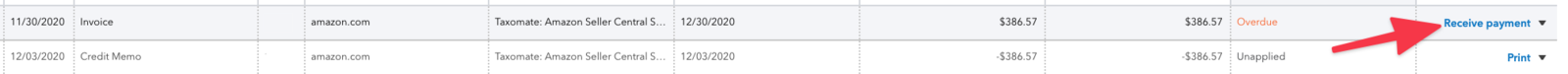

To reconcile the invoice and credit memo, select Receive Payment on the invoice located in Invoicing > All Sales.

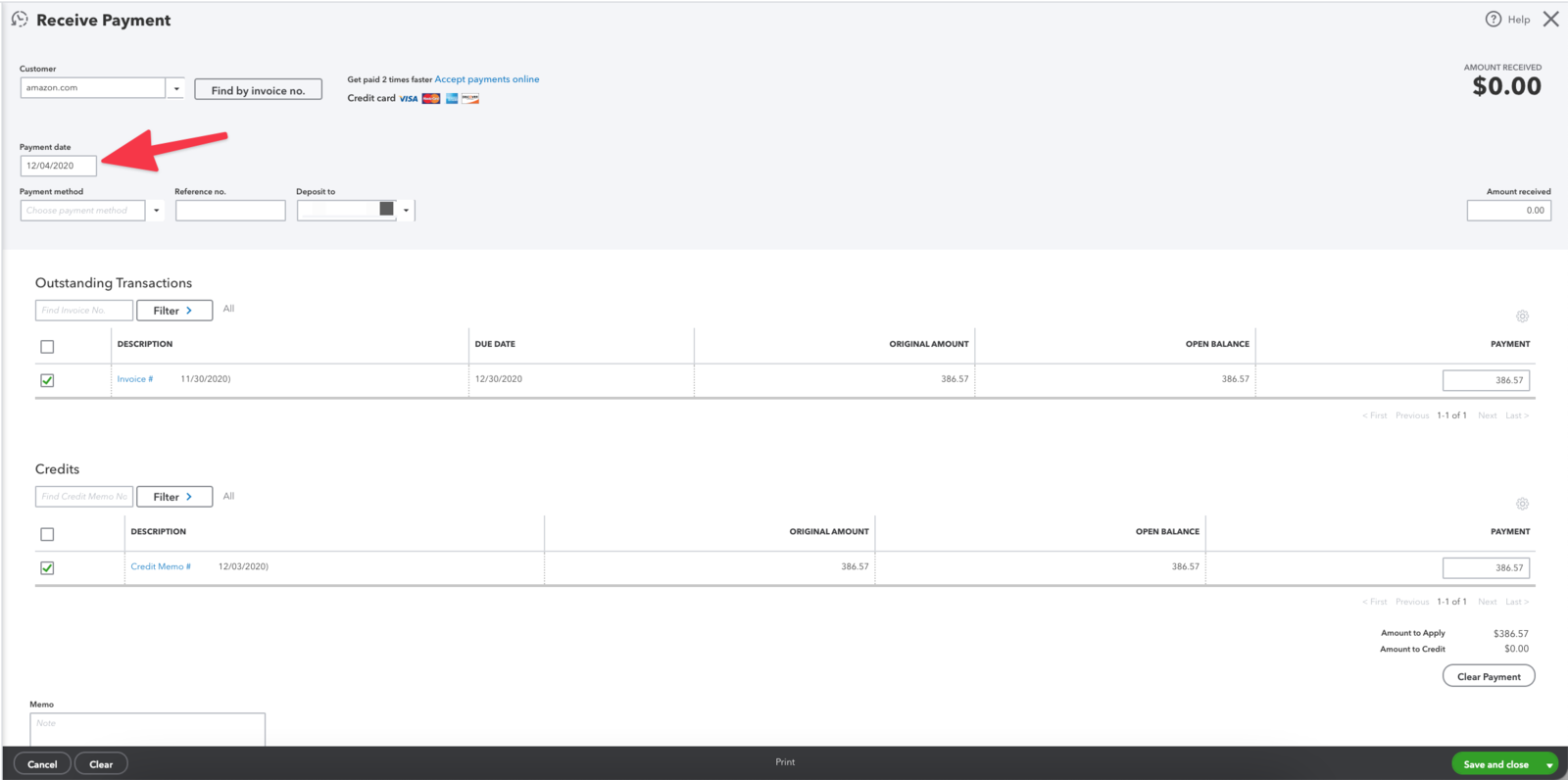

In receive payment, set the date to the deposit date of the settlement and then select the invoice and credit memo. The final total should be $0.

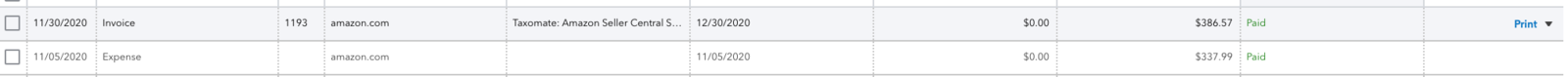

The invoice should now be displayed as Paid.

In the event you see the Current Reserve Amount in the settlement but there are other transactions making the settlement greater or less than $0, Amazon may only be withholding a portion of that settlement. You would reconcile the settlement the same as you would any other.